Charles Schwab currently offers commission-free trades for 105 ETFs. Schwab has its own "in-house" brand of ETFs (15 total) which provide exposure to the most common asset classes, and are good proxies for more popular ETFs. These funds are relatively new and unknown to most investors, but using them can be a great way to reduce investment expenses. In addition to zero commission, Schwab has also established itself as a low-cost leader by keeping the annual expense ratio of the ETFs very low.

Charles Schwab currently offers commission-free trades for 105 ETFs. Schwab has its own "in-house" brand of ETFs (15 total) which provide exposure to the most common asset classes, and are good proxies for more popular ETFs. These funds are relatively new and unknown to most investors, but using them can be a great way to reduce investment expenses. In addition to zero commission, Schwab has also established itself as a low-cost leader by keeping the annual expense ratio of the ETFs very low.

For example, consider the following comparisons. In our model portfolios, we use SPY for exposure to U.S. stocks, which has an annual expense ratio of 0.09%. Schwab's commission-free alternative (SCHX) will cost you only 0.04 percent. Differences in emerging markets stocks are even more pronounced: 0.15% for Schwab SCHE versus 0.69% per year for the more popular choice (EEM). In real estate, Schwab SCHH (0.07%) also handily beats our usual choice of ICF (0.35%). Even in bonds, Schwab SCHR (0.10%) is cheaper to own than the industry standard IEF (0.15%). While these differences might seem small, add them up and compound over an investing lifetime and you might be pleasantly surprised to see how many additional dollars end up in your account.

To find a good substitute ETF, you need to first make sure that the fund has a high correlation to the original. We find these funds by systematically measuring the correlation of the daily returns of each commission-free ETF offered by Schwab, and comparing that to our usual set of 9 ETFs.

The table below summarizes the ETFs we use in our Adaptive Portfolios, and list the zero-commission Schwab ETF that you can substitute for each. Scroll down or click any Schwab ETF symbol to see the detailed analysis for that ETF.

| Asset Class |

Usual ETF Symbol |

Schwab Commission Free Alternative |

|---|---|---|

| U.S. Stocks | SPY | SCHX, SCHB |

| Medium-Term U.S. Bonds | IEF | SCHR |

| Long-Term U.S. Bonds | TLT | TLO ? |

| European Stocks | IEV | SCHF |

| Emerging Markets Stocks | EEM | SCHE |

| U.S. Real Estate (REITs) | ICF | SCHH |

| International Real Estate | RWX | - |

| Commodities | DBC | USCI ? |

| Gold | GLD | SGOL |

U.S. Stocks: use Schwab U.S. Large-Cap ETF (SCHX) or Schwab U.S. Broad Market ETF (SCHB)

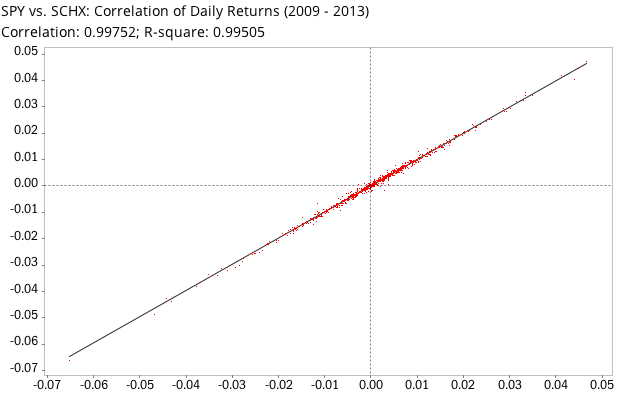

Our model portfolios use the SPDR S&P 500 Index Fund (SPY) to represent U.S. stocks. Schwab offers two commission-free ETFs to invest in this asset class. As shown in the first chart below, the Schwab U.S. Large-Cap ETF (SCHX) has a 0.998 correlation to the SPY, which is about as good as it gets (1.0 being a perfect proxy). SCHX tracks a different index: the Dow Jones U.S. Large-Cap Total Stock Market Index, which is a large cap index of the top 750 U.S. stocks. In practice this has performed very similar to the S&P 500 (which is what the SPY tracks), since Schwab launched the fund in 2009:

SCHX has an annual expense ratio of 0.04%, which is lower than SPY (0.09%). It currently has 1.37 billion dollars under management, and trades an average of 237,800 shares per day, both solid numbers.

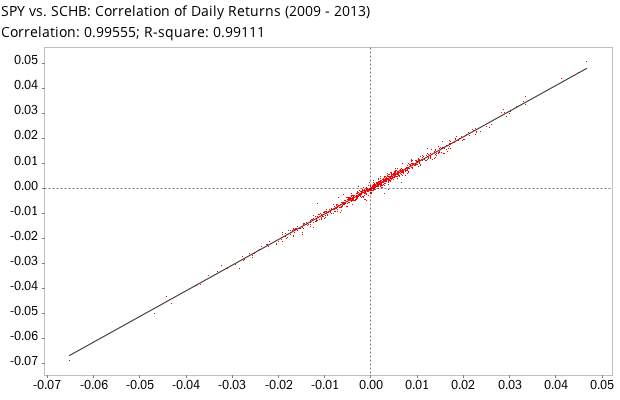

If you prefer a U.S. stock fund that tracks more than just large caps, take a look at Schwab U.S. Broad Market ETF (SCHB). This fund mirrors the Dow Jones U.S. Broad Stock Market Index, consisting of the largest 2,500 publicly traded U.S. companies. As shown in the correlation chart below, SCHB also is an excellent proxy for SPY, with a correlation coefficient of 0.996 since inception in 2009. With an annual expense ratio of just 0.04 percent, 1.77 billion dollars under management and average daily trading volume of 319,200 shares, it is also fine choice to use in any of our strategies:

Medium-Term U.S. Bonds: use Schwab Intermediate-Term U.S. Treasury (SCHR)

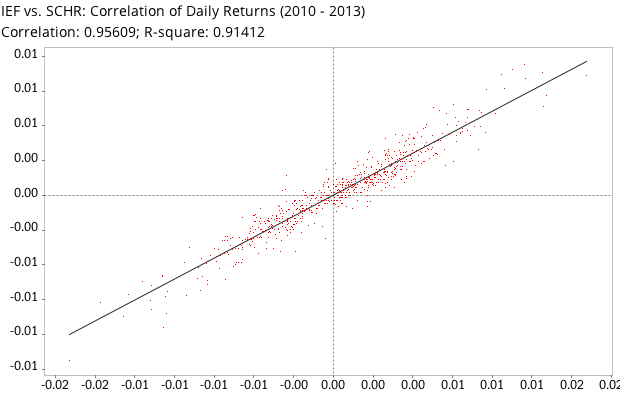

For exposure to intermediate U.S. bonds, Schwab offers the commission-free SCHR fund. As noted, it has a lower expense ratio than our usual choice IEF (0.10% per year versus 0.15%), with $218 million under management, and trades ~45,800 shares per day. With a correlation coefficient of 0.956 against IEF, it is a very good (although not perfect) proxy:

BTW, the low trading volume in SCHR (which you see in other new or unpopular ETFs) needlessly scares away investors who think that since ETFs trade like stocks, low trading volume must be a bad thing (low liquidity, large price spreads, impact on the market for larger orders, etc). This is not true for ETFs: there are many parties working behind the scenes to facilitate good execution: the ETF sponsor, the custodian bank and Authorized Participants (APs). The main thing you need to be concerned about is the liquidity of the underlying securities that the ETF invests in, which in the case of major asset classes is often high.

Long-Term U.S. Bonds

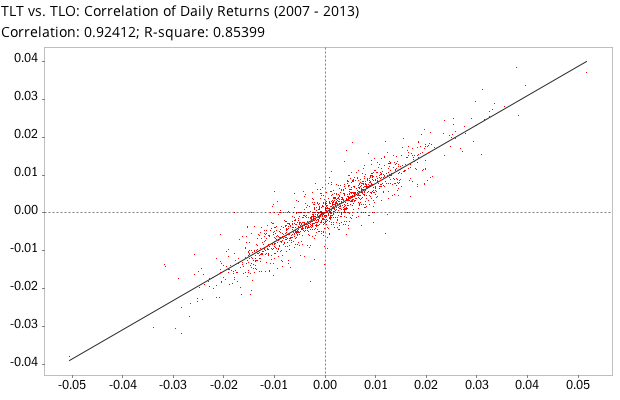

In our model portfolios we use iShares Barclays 20+ Year Treasury Bond (TLT) for exposure to long-term bonds. Of all the commission-free ETFs available at Schwab, the SPDR Barclays Capital Long Term Treasury (TLO) has the highest correlation (0.92). That's on the low side of what we'd like to see. The funds track different indexes: the TLT tracks U.S. Treasury bonds with 20+ year maturities, while the TLO tracks those with 10+ year maturities. Investors with smaller accounts (where trading commissions represent a major drag) should consider TLO as a proxy for TLT. For larger accounts it may be best to stick with TLT. The longer durations in TLT lead to greater volatility, which in an actively managed strategy (such as our Adaptive Portfolios) can be a source of positive returns.

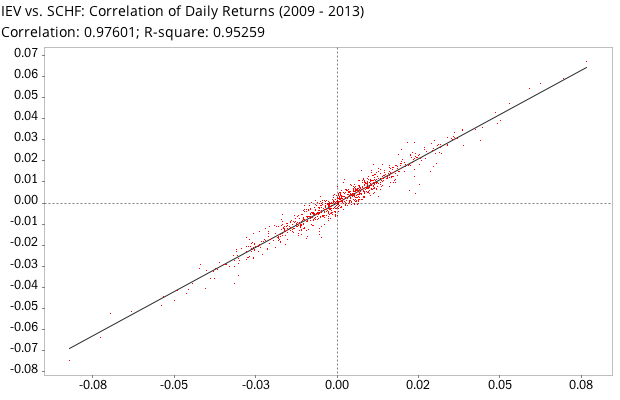

European Stocks: consider Schwab Schwab International Equity ETF (SCHF)

For exposure to European equities, our model portfolios use the iShares S&P Europe 350 ETF (IEV). The Schwab commission-free ETF with the highest correlation (0.976) is Schwab International Equity (SCHF). That's very good, and for the time being it's fine to use SCHF as a proxy, but investors should be aware that the Schwab fund does track a different index: FTSE Developed ex-U.S. stocks. In practice since 2009 the two funds have been very correlated, but this may change somewhat in the future.

Trading 120,000 shares per day, with a total of $1.2 billion dollars under management and an expense ratio of just 0.09%, this Schwab fund certainly compares favorably against IEV (also $1.2B AUM, expenses of 0.60% per year).

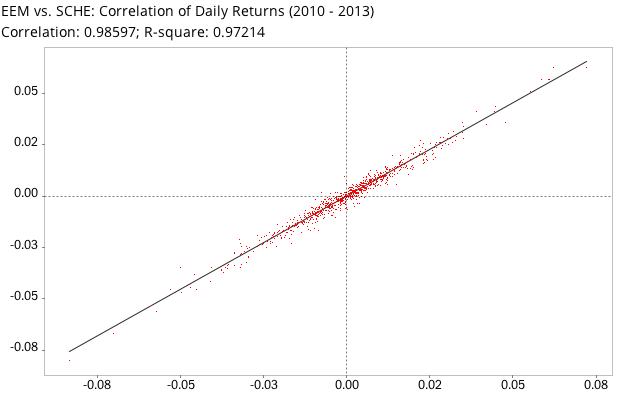

Emerging Markets Stocks: use Schwab Emerging Markets Equity ETF (SCHE)

In our model portfolios we use EEM (iShares MSCI Emerging Markets Index) for exposure to emerging markets equities. Schwab offers a highly correlated (r=0.986) zero-commission alternative: Schwab Emerging Markets Equity ETF (SCHE). This fund has an average daily trading volume of 233,600 shares, a total of $850 million under management, and an annual expense ratio of 0.15 percent (which is extremely low for emerging markets ETFs: compare to 0.69% for EEM). It tracks the FTSE Emerging Index. All this makes SCHE an excellent alternative for EEM.

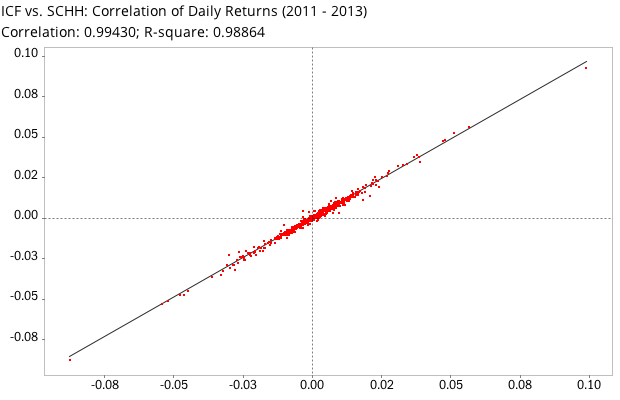

U.S. Real Estate (REITs): use Schwab U.S. REIT ETF (SCHH)

There are a number of good U.S. REIT funds on the market. A popular choice is Vanguard REIT Index ETF (VNQ). In our model portfolios we use iShares Cohen & Steers Realty Majors (ICF). If you're a Schwab customer, take a look at Schwab U.S. REIT ETF (SCHH). With a correlation coefficient of 0.989 against ICF, its returns are going to be practically identical. SCHH tracks the Dow Jones U.S. Select REIT Index, has $557 million under management, trades 122,400 shares per day, and will cost you only 0.07% in annual expenses (lower than even Vanguard's VNQ at 0.10% per year). What's not to like?

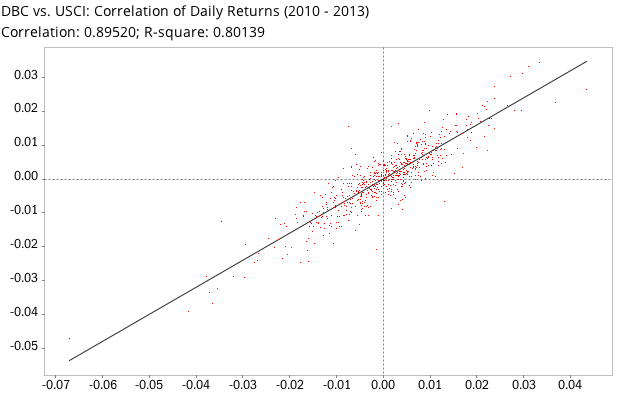

Commodities

Our model portfolios use the PowerShares DB Commodity Index Tracking Fund (DBC) for exposure to commodities. Of all the Schwab commission-free ETFs, the fund that most closely matches DBC's returns is United States Commodity Index ETF (USCI). But notice the low-ish correlation coefficient of 0.895, not a great match:

It's not surprising that there's no better choice: of all asset classes, commodities are most problematic to get exposure to in ETFs. While USCI can be used as a substitute for DBC, and you will certainly get exposure to commodities, your mileage may vary (as far as how closely it will track our model portfolio returns).

Gold: use ETFS Physical Swiss Gold Shares (SGOL)

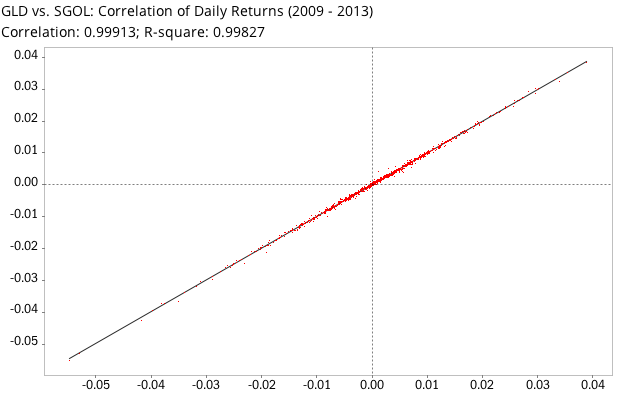

On the other hand, as a Schwab customer, you can easily substitute (and trade for zero-commission) the ETFS Physical Swiss Gold Shares (SGOL) for the widely held SPDR Gold Shares ETF (GLD). Both ETFs hold physical gold bullion. SGOLD is certainly less popular (trades 88,600 shares per day, $1.58 billion assets under management). It's just a tad cheaper to own than GLD (0.39% versus 0.40%). The correlation chart shows that — as you'd expect — these two are definitely exchangeable (r=0.999):

Comments

To add a comment, please Sign In.